We know: money has been tight for so long that a total crisis seems minutes away. Bills are piling up, you’re cutting costs wherever you can, and maybe even skipping meals.

We know: money has been tight for so long that a total crisis seems minutes away. Bills are piling up, you’re cutting costs wherever you can, and maybe even skipping meals.

Fortunately, some help is on the way. Earlier this month, Democrats* in Congress passed Pres. Biden’s $1.9 trillion pandemic relief package. While Senate rules blocked them from using the American Rescue Plan Act to raise the minimum wage to $15/hr, they were able to put in place a bunch of provisions to give financial aid to struggling households.

The American Rescue Plan also contains funds to help defeat the virus and reopen schools. Below is what the ARP will provide in terms of direct relief to those in need.

* Not a single Republican in the U.S. House or the Senate voted to support the Plan.

DIRECT CASH ASSISTANCE

2021 Recovery Rebates/Economic Impact Payment (EIP) for Individuals

(Updated June 15)

What: A third direct payment to households to help deal with the economic impact of the pandemic

Amount: $1,400 per person on your tax return

Eligibility: Based on 2019 or 2020 income

- Taxpayer, spouse, and dependents with a valid social security number, including adult dependents

- Must be below an annual income of $80,000 for single filers, $120,000 for heads of household with one child, and $160,000 for joint filers or surviving spouse

- An eligible individual is anyone except:

- Any nonresident alien individual

- Any individual who is a dependent of another taxpayer as of January 1, 2021

When: These payments began going out in March. As of June 15, there are a few options if you have not yet received this stimulus payment or the dependent portion:

- If you are required to file a 2020 tax return but haven’t filed it yet, there is still time to file a return. Click here for free tax preparation options.

- If you are not required to file, use the Non-Filers tool on the IRS website to claim your stimulus payment. If you need assistance using the non-filers tool, there is virtual help available.

- If you already filed a 2020 tax return, the IRS will issue your stimulus payment after your return is processed. If you do not receive it by December 31st, 2021, you can claim it on your 2021 tax return that you file next year.

Unemployment

What: An extension of extra benefits for the unemployed

Amount: $300/week. The first $10,200 ($20,400 for joint filers) of unemployment benefits for 2020 will be nontaxable for taxpayers with an adjusted gross income of less than $150,000.

When: Through Sep. 6, 2021

Eligibility:

- The Pandemic Unemployment Assistance program provides benefits to freelancers, gig workers, independent contractors, and certain people affected by the pandemic.

- The Pandemic Emergency Unemployment Compensation program increases the duration of payments for those in the traditional state unemployment system.

Child Tax Credit (CTC) expansion

What: An increase to the CTC from the usual $2,000 per eligible child.

Amount: $3,000 per eligible child under age 18 and $3,600 per child under age 6.

When: For 2021. Families will get 50% of the credit as periodic payments (how frequently is still to be determined) starting in July and can claim the rest when they file their 2021 taxes.

Eligibility: Below an annual income of $75,000 ($150,000 for joint filers or surviving spouse; $112,500 for head of household).

![]() Learn more about the expanded CTC

Learn more about the expanded CTC

Earned Income Tax Credit (EITC) expansion

What: Expanded eligibility and an increase to the EITC for workers without children

Amount: The Act raises the maximum EITC from roughly $540 to roughly $1,500 and raises the income limit to qualify from about $16,000 to at least $21,000.

When: Claim when you file your 2021 taxes.

Eligibility:

- The minimum age to claim the EITC for taxpayers without children (childless EITC) is reduced from age 25 to age 19 (except full-time students).

- The maximum age limit of 65 for claiming the childless EITC has been eliminated.

- Taxpayers may use their earned income from the 2019 tax year to determine their EITC when filing their 2021 taxes if their 2021 earned income was less than 2019 earned income. That could allow them to receive a bigger EITC.

- The disqualified investment income limit also increases from $3,650 (2020) to $10,000.

FOOD AND NUTRITION

Pandemic EBT

What: An extension of P-EBT benefits to help eligible families buy food for their school-age and pre-school-age children. The federal government has not released guidance yet on summer P-EBT regarding how much the benefits will be or when they will be sent. We anticipate that summer P-EBT eligibility will be somewhat more expansive and will include children who attended school entirely in-person this school year.

When: Through this summer

Amount/Eligibility: Learn more about P-EBT for the 2020-2021 school year in PA

SNAP/Food Stamps

What: An increase to benefit amounts for all recipients (and a funding increase to states to help them administer additional applications)

Amount: 15% increase to benefit amounts

When: Through Sep. 30, 2021

Eligibility: All SNAP households. Learn more about SNAP eligibility in PA.

Special Supplemental Nutrition Program for Women, Infants, and Children (WIC)

What: An increase in state funding to allow them to improve WIC access and increase fruit and vegetable benefits

Amount: Option for a four-month increase in the fruit and vegetable benefit of up to $35 monthly

When: TBD

Eligibility: WIC households. Learn more about WIC eligibility.

HEALTHCARE AND FAMILY CARE

COBRA

What: An increase to federal assistance for healthcare premiums

Amount: A subsidy equal to 100% of premium cost i.e. recipients would pay no premiums

When: April 1, 2021, through Sept. 30, 2021

Dependent Care Assistance

What: An increase to this tax credit

Amount:

- The credit is fully refundable

- The dollar limit for eligible expenses increases from $3,000 to $8,000 for one eligible child and $6,000 to $16,000 for two or more eligible children.

- The maximum credit rate increased from 35% to 50% and the maximum income increased from $15,000 to $125,000.

- The exclusion for employer-provided dependent care assistance increases from $5,000 to $10,500 ($5,250 for married filing separately).

When: For 2021

Premium Tax Credit (PTC)

What: Reduces health care premiums for low- and middle-income families by increasing the Affordable Care Act’s (ACA) premium tax credit (PTC)

When: For 2021 and 2022. (ACA enrollment is open now until May 15, 2021.)

Amount: See the chart here

- Individuals and families would now pay 0 to no more than 8.5% of their income towards coverage (down from the current amount of nearly 10%).

- Subsidies for lower-income individuals and families would be increased, in many cases eliminating their premiums entirely. Most low-income families who qualify for other benefits such as LIHEAP or SNAP will not have any payments.

- People collecting unemployment benefits would pay no premiums in 2021.

- Those earning more than the current cap of 400% of the federal poverty level—about $51,000 for an individual and $104,800 for a family of four in 2021—would become eligible for help for the first time.

HOUSING

HOUSING

What: Increases state and local government funds to help those low-income households cover back rent, rent assistance, and utility bills; to help those at risk of homelessness and in need of emergency housing vouchers; and help homeowners having difficulty paying their mortgages, utilities, and property taxes.

Amount: The City of Pittsburgh and Allegheny County are contributing a total of $80 million towards the Emergency Rental Assistance Program (ERAP) to provide up to 12 months of rent and utility assistance

When: Applications started Mar. 15, 2021. You can apply:

- online at https://covidrentrelief.alleghenycounty.us/ (or learn how to apply by phone)

- at a drop-in center (see map here)

Eligibility: You can apply if you’re a renter living in a household with all of the following:

- at least one person who’s lost income or suffered financially due to COVID-19

- at least one person at risk of homelessness/eviction (having late rent is an automatic qualifier)

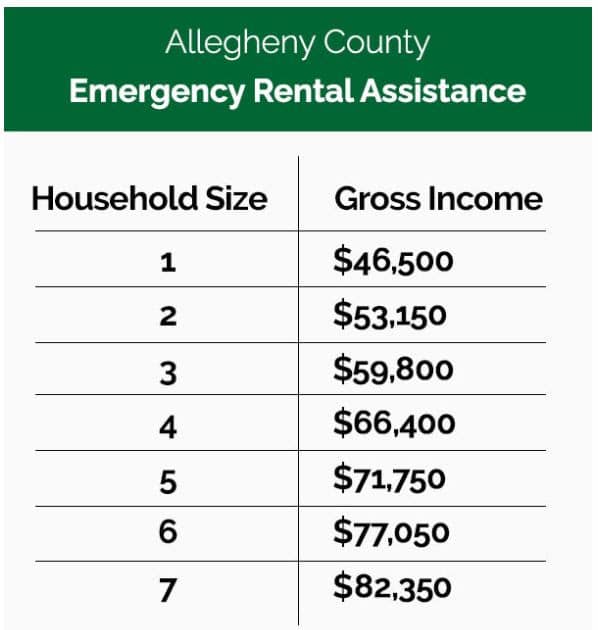

- a total household income below 80% area median income (see chart for Allegheny County)

OTHER ASSISTANCE

Student Loan Forgiveness

What: A modification of the treatment of student loan forgiveness

When: In 2021 through 2025

Amount/Eligibility:

- The discharge of student loans as cancellation of debt is not included in gross income.

- Student loan borrowers who made qualified student loan payments after March 13 could have those payments refunded if they notify their loan servicer.

- Tax refund and/or wage garnishment has been suspended through Sept. 30, 2021, for those who have defaulted on federal student loan debt.

Sources

www.natptax.com/TaxKnowledgeCenter/IRS%20Tax%20Resources/2021AmericanRescuePlanActSummary.pdf

https://www.cnn.com/2021/03/04/politics/senate-stimulus-package-what-to-expect-guide/index.html

No comments yet.