Tax Appointment Scheduling Begins January 12th for the 2026 Tax Season

¿Necesitas ayuda en español?

Ways to File Your Taxes

Just Harvest’s tax preparation sites are open from January 21 – April 15. Find tax site locations & hours further down on this page.

Free online tax preparation is available through Get Your Refund from January through October for those with income less than $70,000 in 2025

My Free Taxes is a free option to file at home for households with less than $89,000 of 2025 income.

Refer to our DIY tax preparation guide to get started.

FAQs

-

If Just Harvest did your taxes in a previous year, we can get you copies of your tax records or prior year AGIs. Please call (412) 431-8960 x212 or send an email that includes your name and the last 4 digits of your SSN to taxhelp@justharvest.org. You can also go to www.irs.gov/individuals/get-transcript to obtain an online transcript of your tax returns from the IRS.

-

No, we do not provide virtual appointments. See above for options to file your taxes at home for free.

-

No. Due to volume of appointments, we do not have a cancellation list. We recommend checking for appointment availability the night before or the day of your desired appointment for potential openings due to last minute cancellations.

-

Learn more at https://www.getyourrefund.org/en/tax-questions

-

Appointments typically range from 1.5-2 hours.

-

Bring printed copies of the following documents to your tax appointment.

These documents are required for everyone:

Photo identification (for you and your spouse, if filing jointly). Acceptable documents include a driver’s license, state ID, or passport.

Social security cards or Individual Taxpayer Identification Number (ITIN) letter for yourself, your spouse, and each person to be claimed on your return.

W-2 forms for all jobs held in 2025.

All 1099 forms, including income received from unemployment (1099-G), social security (1099-SSA), pension payments (1099-R), bank account interest (1099-INT), and dividends (1099-DIV).

The routing and account number for your bank account for direct deposit (the IRS no longer issues refunds by check)

Bring these documents if they apply to you:

If anyone on your tax return is in post-secondary education (college): Record of tuition payments (1098-T), plus receipts for college materials and books. A student account statement from the Financial Aid office can also be helpful.

If you paid for childcare: total expenses and name, address, and tax ID number of provider(s).

Form 1095 A B or C with health insurance information if you received one.

If you own your home: Mortgage interest statement and property tax receipts.

Local tax forms or any tax booklets you’ve received in the mail.

A copy of last year’s tax return if you have it.

Your last paystub(s) from 2025.

Anything that says “This is important for your taxes.”

About our Free Tax Prep Program.

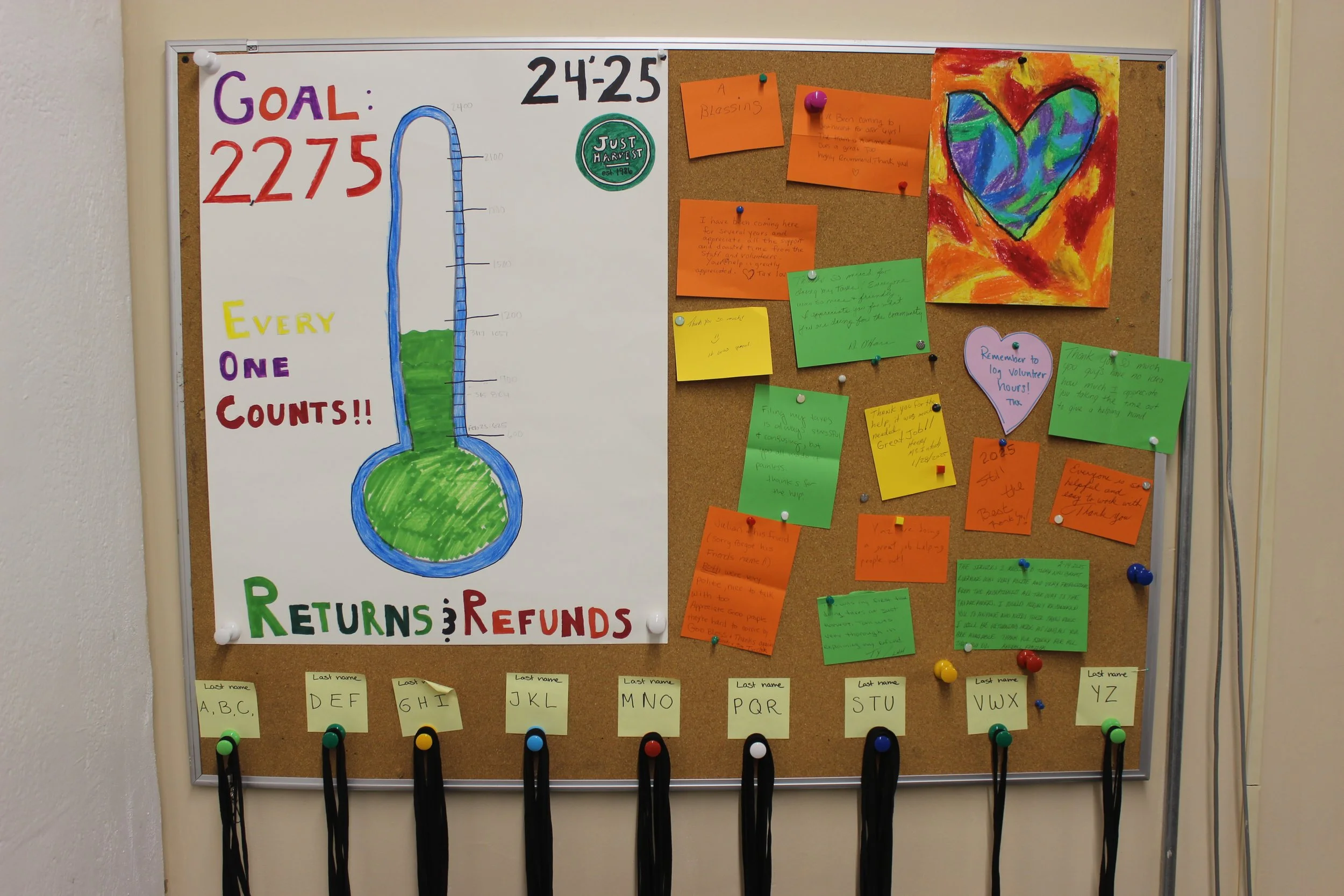

Every year, Just Harvest helps low-income households file their income tax returns and maximize their tax refund. Launched in 2003, Just Harvest’s free IRS-certified tax return preparation service is now one of the largest in Pennsylvania.

Just Harvest also manages the Free Tax Preparation Coalition (sponsored by United Way of Southwestern PA), which provides free income tax return preparation throughout the region.

We are committed to providing high-quality free tax preparation to allow workers to keep the tax credits they’ve earned, not lose them to tax preparation fees and advance refund loans.

Our program has continuously expanded to meet the needs of communities in the Pittsburgh area. We have four tax sites that offer in-person tax help, ITIN application assistance, and interpretation services for Pittsburgh’s growing immigrant communities.

-

317 E Carson St, Suite 153, Pittsburgh, PA 15219

By Appointment Only

-

2305 Bedford Ave, Pittsburgh, PA 15219

By Appointment Only

-

595 Beatty Road, Rooms S585 and S586, Monroeville, PA 15146

By Appointment Only

-

3000 Brownsville Road, Suite C, Pittsburgh, PA 15227

By Appointment Only

Contact Any of Our Tax Sites

Give Us a Call: 412-431-8960

Email Us: taxhelp@justharvest.org

Learn a Little About Our Tax Clients, Volunteers & Staff

-

All of us should be able to have a roof over our heads, take care of our kids, and live with dignity. The 2021 Child Tax Credit was an absolute blessing that changed my life for the better so I could do just that.

As a single mom in Pittsburgh who recently left a very unhealthy relationship, this money saved my life. I’ve joined Just Harvest in support of Prosperity Now’s campaign to #BuildBackForJustice to ask Congress to expand the Child Tax Credit in any federal spending package to help other people like me provide for our families.

With the money I received from the Child Tax Credit, I was able to get basic necessities for my son like diapers and food – and I was also able to set some money aside to give my son a proper birthday and celebrate holidays like he deserved. As any parent knows, children grow so fast and there is no price tag you can put on special moments. Having this support allowed me and my family to not stress but, instead, have the breathing room to thrive.

It’s easy to get caught up in politics as Congress reconvenes around a federal spending package. It’s easy to think this isn’t important when you have the financial means to sustain your family.

But the numbers don’t lie. Thanks to the expanded CTC, millions of families were able to get caught up on utility bills, buy food for their families, and have the security of monthly payments to help make ends meet.

I am one of those people. To be able to provide for my son and not be forced to call his dad for anything was freeing and empowering.

We must build back for the millions who need support to raise our kids and have a place to live. We must build back for freedom. We must build back for justice.

At the end of the day, this isn’t about politics. This is about real people like me who are impacted by federal policy decisions who need to be able to live and thrive with dignity.

-

Janice, a resident of South Hills, has worked as a nursing assistant for two decades. The hours involved often made tax season difficult for her, especially because many tax sites have limited hours that don’t line up with her availability.

That’s why when a friend told her this year about Just Harvest, she was glad to learn that we have available appointments six days a week from morning to evening.

Janice came to Just Harvest with Bill, her husband of five years. They were disappointed to find out their lack of health insurance resulted in a penalty on their tax return, but appreciated their preparer explaining what had happened. They were happy to learn that due to the Tax Cuts and Jobs Act of 2017, the penalty would not exist next year.

The penalty was an Affordable Care Act measure designed to push people lacking coverage (with some exceptions) to purchase it. Healthy people (who are only one illness or accident away from needing medical care) would thereby cover the costs of those with current health problems. This “individual mandate” would also protect the uninsured from the financially ruinous event of suddenly needing coverage but not having it.

The ACA intended for subsidies to help people afford purchasing coverage, and for Medicaid to be expanded to cover more people. But state governments and the Trump administration have blocked that needed assistance.

“The federal government took away the tax penalty for being uninsured,” said our tax program coordinator Barbara Jakab, “but didn’t do anything to ensure access to insurance.” Clearly, our health system’s rising costs must be addressed, and it must be a basic right to receive medical treatment without going into debt.

While at the South Side location, they were also excited to learn about Just Harvest’s other community resources like voter registration and food stamps screening. It’s important to them that their communities have access to the resources that help them thrive.

Janice and Bill look forward to getting back their return so they can complete the repairs for their car and motorcycle. They also plan to put part of their return toward a vacation to Niagara Falls.

We wish the best to the happy couple!

-

Audrey, a resident of the Hill district, worked full-time for Heinz Ketchup for 29 years. She liked her job and enjoyed working in every department, including serving as a supervisor.

In 1996, Audrey was diagnosed with rheumatoid arthritis. Her job was physically intensive and had high levels of stress which exacerbated the pain from her arthritis. She made the difficult decision of going on disability retirement, an earlier retirement then she had planned.

Though it was difficult, Heinz is a good company and still sends her a Christmas gifts every year.

Audrey heard about the Just Harvest free tax program from a friend and began getting her taxes prepared at the South Side site about 7 or 8 years ago. When the Bedford site opened, Audrey was thrilled to have this service just a few blocks from her home and has been going there for the last three years.

Prior to Just Harvest, Audrey was paying to have her taxes done at H&R Block and expressed that this free tax program is “very beneficial to me”. The volunteers are always “courteous and efficient,” making it a great experience for Audrey.

She recommends it to a lot of people saying that “it’s to your advantage to go instead of paying an astronomical amount of money.” Plus she says she has met some really nice people at Just Harvest.

In the past, Audrey has often used her refund towards medical bills and co-pays for medication, since she has a lot of expenses due to her rheumatoid arthritis. This year, she plans to put it towards her upcoming car inspection and the repairs that will be needed. With her arthritis and asthma it is critical that Audrey keeps her car up and running.

Volunteers connect hard-working people to their full tax refunds making a huge difference in our community. With your help, we can continue to expand our impact. No professional experience required & free training is provided!

Volunteer registration for the 2026 tax season is from October 25 through January 23. If you’re interested in volunteering for the next tax season, reach out to our Free Tax Prep Volunteer Manager through the form below.

Volunteer!

2025 Free Tax Prep Coalition Partners.

Just Harvest (leading member) — Allegheny Valley Association of Churches — Blueprints — Human Services Mon Valley — Internal Revenue Service — North Hills Community Outreach — Project Destiny — PA 2-1-1 Southwest — Robert Morris University — United Way of Southwestern PA — University of Pittsburgh/Carnegie Library — Veteran's Leadership Program of Western PA — Westmoreland Community Action — YMCA of Greater Pittsburgh